Business Insurance in and around South Bend

Calling all small business owners of South Bend!

Cover all the bases for your small business

Cost Effective Insurance For Your Business.

Whether you own a a pet groomer, a window treatment store, or an antique store, State Farm has small business insurance that can help. That way, amid all the various moving pieces and decisions, you can focus on making this adventure a success.

Calling all small business owners of South Bend!

Cover all the bases for your small business

Strictly Business With State Farm

Your business thrives off your commitment determination, and having dependable coverage with State Farm. While you do what you love and support your customers, let State Farm do their part in supporting you with commercial auto policies, worker’s compensation and business owners policies.

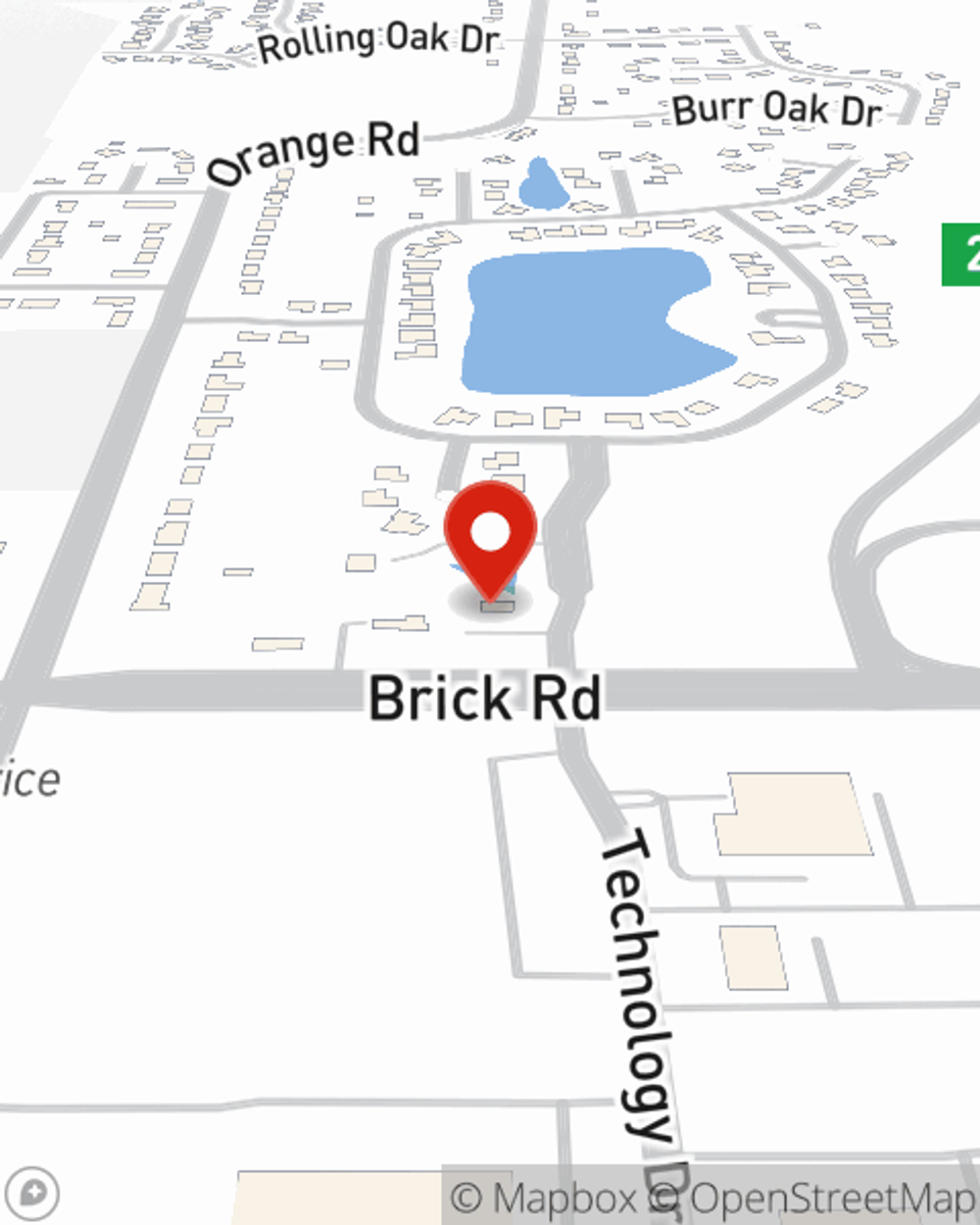

As a small business owner as well, agent Tim Grauel understands that there is a lot on your plate. Get in touch with Tim Grauel today to get more information on your options.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Tim Grauel

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.